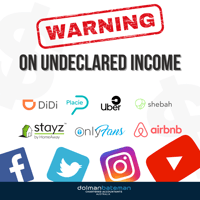

The Australian Taxation Office (ATO) has recently issued a warning that individuals earning income...

Businesses with large tax debts may become available to credit reporting

If your business has a large amount of tax outstanding with the ATO, now is the time to get into contact with your trusted accountants or directly with the ATO.

The government is proposing an amendment to the law which would enable the ATO to disclose tax debts to credit reporting bureaus. This measure would mean there is greater transparency in the business community when dealing with businesses which have significant debts with the ATO.

The proposal, found in the Treasury Laws Amendment (2019 Tax Integrity and Other Measures No.1) Bill 2019, advises that businesses who are registered with the Australian Business Register, with tax debts of greater than $100,000 and who do not engage with the ATO regarding these debts will have their debt information released to credit reporting agencies.

The aims of this measure are two-fold:

- To provide an incentive for businesses to be active in dealing with their tax debts and provide engagement with the ATO to lower their outstanding balances.

- To provide warning to other businesses that they could be dealing with a payment risk when dealing with a business which does not actively act on their tax debts to the ATO.

Should this bill become law, the best approach is to get into contact with an accountant, tax agent or the ATO directly to assess the state of the business, and to provide engagement with the ATO.

If your business is facing a large tax debt, or you’re worried about your business performance, don’t hesitate in approaching a trusted business advisor to help navigate your business into a positive future.

Call Dolman Bateman on +61 2 9411 5422 if you are looking for a trusted Business advisor.

Disclaimer

This information is not to be relied upon without speaking to your accountant, tax agent or financial adviser depending on the advice