Effect of Income on Negative Geared Investment Property

Tax is one of the main reasons why negatively geared investment property is so popular. The losses that you make in renting your investment property can be offset against your other (salary) income. The tax savings that you make can change a negatively geared property into a positive geared investment.

The level of your income will have a significant impact on the after tax returns of your investment property. Those in the top tax bracket (46.5% over $180,000) will receive a bigger tax benefit than those on lower tax brackets. The full time male average income is about $74,000 which is in the 31.5% tax bracket.

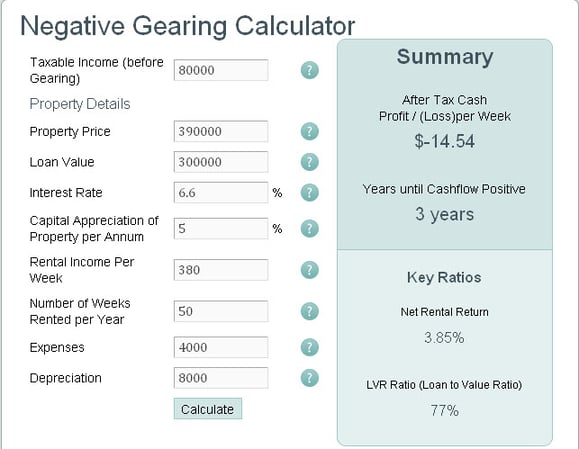

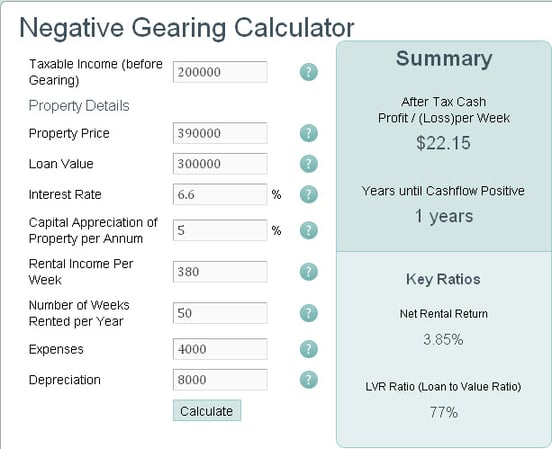

I have used the examples below using our Negative Gearing Calculator to illustrate the effect of the level of income on your investment property returns. In each case, all variables are the same except for the income level, which in $80,000 in example 1 and $200,000 in example 2.

Example 1:

The cost per week is $14.54 on an income of $80,000 and the property is still negatively geared.

Example 2:

The higher level of income means that the property is now positively geared and the investor is $22.15 better off after tax per week.

Our Negative Gearing Calculator enables you to test a variety of different variables including the effect of interest rate rises on your after tax income.