There are five basic business methodologies used in Family Law matters as detailed in Wilde & Wilde...

Future Maintainable Earnings - Business Valuation Methodologies

The Future Maintainable Earnings (FME) methodology is the most common method of valuing profitable businesses in Australia.

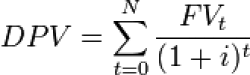

The future maintainable earnings methodology is a derivation or simplification of the Discounted Cash Flow (DCF) method. Whilst the discounted cash flow methodology is considered to be superior in determining the value of a business, the information available in a small business is not sufficiently reliable or available for discounted cash flow models.

The future maintainable earnings methodology is a derivation or simplification of the Discounted Cash Flow (DCF) method. Whilst the discounted cash flow methodology is considered to be superior in determining the value of a business, the information available in a small business is not sufficiently reliable or available for discounted cash flow models.

Earnings-based valuations involve capitalising the earnings of the business at an appropriate multiple and require consideration of the following factors:

- Estimation of the future maintainable earnings having regard to historical and forecast operating results, including sensitivity to key industry risk factors, future growth prospects and the general economic outlook.

- Determination of an appropriate capitalisation rate which reflects the purchaser’s required rate of return, risks inherent in the business, future growth possibilities and alternative investment opportunities.

- The separate assessment of surplus or unrelated assets and liabilities, being those items which are not essential to producing the estimated future earnings.

The Future Maintainable Earnings Valuation Process

Our valuation process includes the following:

- Examination of the financial statements.

- Examination of the balance sheet of the business and separation of the assets and liabilities between business assets and liabilities (being those assets and liabilities that are necessary or necessarily incurred in the ordinary operation of the business) and surplus assets and liabilities (being those assets and liabilities that are surplus to the ordinary operations of the business).

- Valuation of the tangible assets and liabilities at net realisable value.

- Determination of future maintainable earnings after making relevant adjustments.

- Determination of a capitalisation rate after taking into account relevant factors.

- Valuation of the total value of the business by applying the capitalisation rate to future maintainable earnings.

- Determination of the goodwill value by deducting the capitalised value less net tangible assets employed in the business.

- Determination of the value of the company being net assets plus goodwill.