We were recently engaged to calculate the economic loss of a taxi operator who was significantly...

PAYG Tax Scam Thwarted by Changes to Australian Tax Laws

At the end of June this year, changes in legislation on Tax were made in attempt to close off tax scams involved in phoenixing activity.

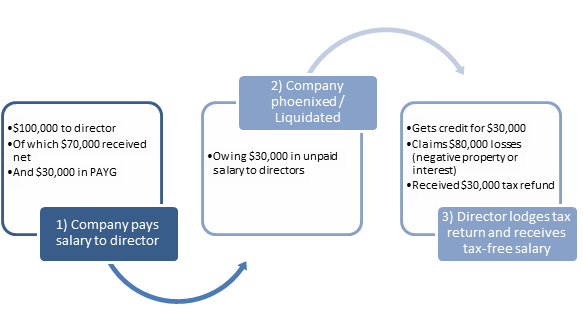

Previously directors were able to pass on the PAYG withholding liabilities to the company entity. This allowed for the situation where companies could file for bankruptcy, whilst the entity was still owing PAYG tax collected. See below for an example, of how the tax scam worked before the changes were made.

The tax changes were made through implementing a new PAYG withholding non-compliance tax which was equal to the amount of unpaid PAYG witholding amounts by the company. Therefore more accountability is placed on directors deterring upper management from exploiting such tax loopholes.

In fact, a report by the Fair Work Ombudman phoenix activity costs Australia between $1.78 and $3.19 billion a year and between $601 and $610 million worth of revenue a year as a result of unpaid tax.