A Guide to Understanding Accountant's Letters

- Arnold Shields

- Mar 8, 2023

- 3 min read

Updated: May 16, 2025

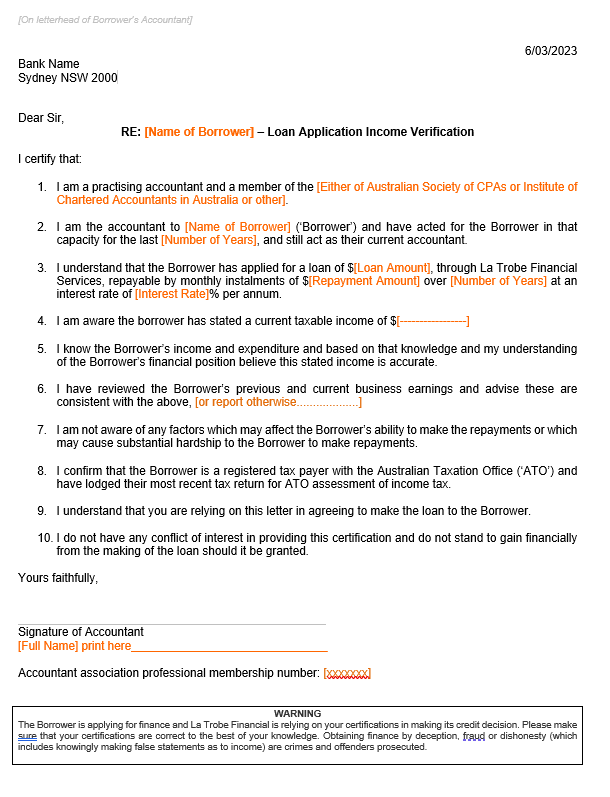

When clients apply for a loan, mortgage, or other financing, lenders often request an Accountant’s Letter. These letters, usually prepared by a registered accountant, aim to verify the client’s financial status and support their loan application. While these letters can be helpful for clients, they come with legal risks that every accountant must carefully manage.

Let’s examine the key risks accountants face when issuing these letters.

1. Liability for False or Misleading Statements

Accountants are seen as trusted professionals whose opinions and certifications influence major financial decisions. If a lender relies on an inaccurate or misleading accountant's letter, and suffers a loss, the accountant may be held liable for damages. This includes:

Financial compensation for losses

Damage to the accountant’s professional reputation

Possible legal action under Australian consumer and financial services laws

The risk is especially high when accountants are pressured by clients to be overly optimistic in their wording or projections.

2. Professional Negligence

If an accountant fails to conduct proper due diligence before issuing a letter—such as reviewing up-to-date financials, verifying supporting documents, or clarifying assumptions—they may be liable for professional negligence. Courts may assess whether a reasonably competent professional would have acted differently under the same circumstances.

Tip: Always document the basis of your statements and ensure the client understands the limitations of your letter.

3. Conflicts of Interest

An accountant must remain objective. If there is a conflict between helping the client secure finance and maintaining independence, it should be disclosed. Ignoring conflicts can lead to ethical breaches, damaged relationships, and disciplinary action.

To manage conflict of interest:

Disclose any relationships to affected parties

Refrain from giving personal opinions on the client’s ability to repay the loan

Maintain a clear scope of engagement

4. Breach of Confidentiality

Clients entrust accountants with sensitive financial data. Including too much personal or business detail in a letter without consent can breach privacy laws, including the Privacy Act 1988.

Always:

Confirm what information can be shared

Obtain written consent where needed

Redact unnecessary personal identifiers

5. Violation of Professional Standards

Accountants must comply with standards set by their professional bodies, such as CPA Australia or Chartered Accountants ANZ. This includes following ethical codes, preparing reports responsibly, and not giving assurances beyond the scope of their engagement.

Breaching these standards can lead to:

Disciplinary action

Suspension or loss of professional membership

Legal consequences under regulatory laws

Best Practices for Accountants Providing Letters

Avoid making statements about future financial performance or creditworthiness

Use disclaimers to limit the scope and intent of the letter

Have engagement letters in place defining the scope of work

Seek legal advice when in doubt

Keep documentation to support every statement made

Final Thoughts

Accountant’s letters are more than just a formality, they carry real legal and professional risks. Accountants must be cautious, accurate, and fully compliant with relevant laws and standards when providing these letters.

Need Guidance on Accountant’s Letters?

At Dolman Bateman, we understand the fine line between helping clients and managing professional risk. If you're a client needing an accountant’s letter, or an accountant seeking advice on drafting one, contact us today. We’re here to help you do it right.

Disclaimer: The information provided in this article is general in nature and does not constitute personal financial, legal or tax advice. While every effort has been made to ensure the accuracy of this content at the time of publication, tax laws and regulations may change, and individual circumstances vary. Dolman Bateman accepts no responsibility or liability for any loss or damage incurred as a result of acting on or relying upon any of the information contained herein. You should seek professional advice tailored to your specific situation before making any financial or tax decision.