Discounted Cash Flow Methodology

- Arnold Shields

- Feb 7, 2011

- 2 min read

Updated: Jun 16, 2025

One of the Core Principles of Valuation

At its core, the value of any asset, whether a business, property, or investment—is based on the expected future cash flows it can generate. This applies to both income-based valuations, such as the Future Maintainable Earnings (FME) method, and market-based valuations, such as Net Realisable Assets. While FME assumes a consistent income stream into perpetuity, the market-based approach looks at what the asset could be realised for if sold today.

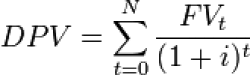

What is the DCF Methodology?

The Discounted Cash Flow (DCF) method is a more detailed and data-driven approach than FME. It involves forecasting the expected future cash flows of a business and then applying a discount rate that reflects both risk and the required return, to calculate the present value of those cash flows.

DCF allows for specific adjustments and assumptions, including variations in revenue, expenditure, capital investment, and working capital—making it a more precise valuation technique, particularly in scenarios where these variables materially affect value.

Forecast Periods: How Long Should You Project?

The forecast period used in a DCF analysis should be long enough to allow the business to reach a sustainable level of earnings, or in the case of a cyclical business, to reflect a full cycle of operations.

Mining and resource-based businesses: project to the end of the resource life.

Established businesses with indefinite lifespans: typically use a 10-year forecast plus a terminal value, which reflects the hypothetical sale value at the end of the forecast.

This terminal value becomes a valuation within a valuation, based on assumptions about sale price, earnings multiple, or asset value at that point in time.

Key Components in DCF Cash Flow Calculation

To accurately forecast cash flows, you need to distinguish between:

Capital expenditure (CapEx): What investment is required to achieve and maintain the forecast income?

Working capital requirements: Consider the cash tied up in debtors, creditors, and inventory.

Non-cash expenses: Remove depreciation and amortisation—they’re accounting entries, not actual cash flows.

Challenges of Applying DCF to Small Business Valuations

While DCF is theoretically robust, it’s often difficult to apply in small business settings. This is due to:

Lack of detailed historical and forecast data

Unreliable or informal financial reporting

High sensitivity to assumptions, particularly for growth, margins, and risk

In most small business valuations, DCF is only practical if high-quality, forward-looking financial information is available. Otherwise, valuers tend to rely on the FME approach, which, although simpler, incorporates similar assumptions in a more stable and cost-effective way.

Disclaimer:

The information provided in this article is general in nature and does not constitute personal financial, legal or tax advice. While every effort has been made to ensure the accuracy of this content at the time of publication, tax laws and regulations may change, and individual circumstances vary. Dolman Bateman accepts no responsibility or liability for any loss or damage incurred as a result of acting on or relying upon any of the information contained herein. You should seek professional advice tailored to your specific situation before making any financial or tax decision.