Do I Need to Pay Tax If I'm an Influencer?

- Feb 17, 2025

- 3 min read

Updated: Jan 21

So You’re Earning Money as an Influencer, Do You Have to Pay Tax?

Whether you're growing your brand on Instagram, YouTube, TikTok, OnlyFans, Twitch, or Patreon, one thing is clear: if you’re making money, the Australian Taxation Office (ATO) wants to know about it.

Short answer? Yes, you absolutely need to pay tax on your influencer income.

Why the ATO Cares About Your Influencer Income

It doesn't matter if you’re not getting a traditional paycheque. If you're earning money from:

Brand deals

Affiliate marketing

Ad revenue

Sponsorships

PR gifts

...you’re generating taxable income under Australian law.

Are You Running a Business?

Here’s how to know if you’re classified as a business by the ATO:

Are your content creation activities consistent and ongoing?

Do you intend to make a profit?

Are you acting like a business (e.g. contracts, invoices, promotions)?

Have you registered for an ABN?

If you answer yes to most of these, you're likely running a business and must comply with business tax obligations.

Even if it's “just a side hustle,” you still need to declare the income.

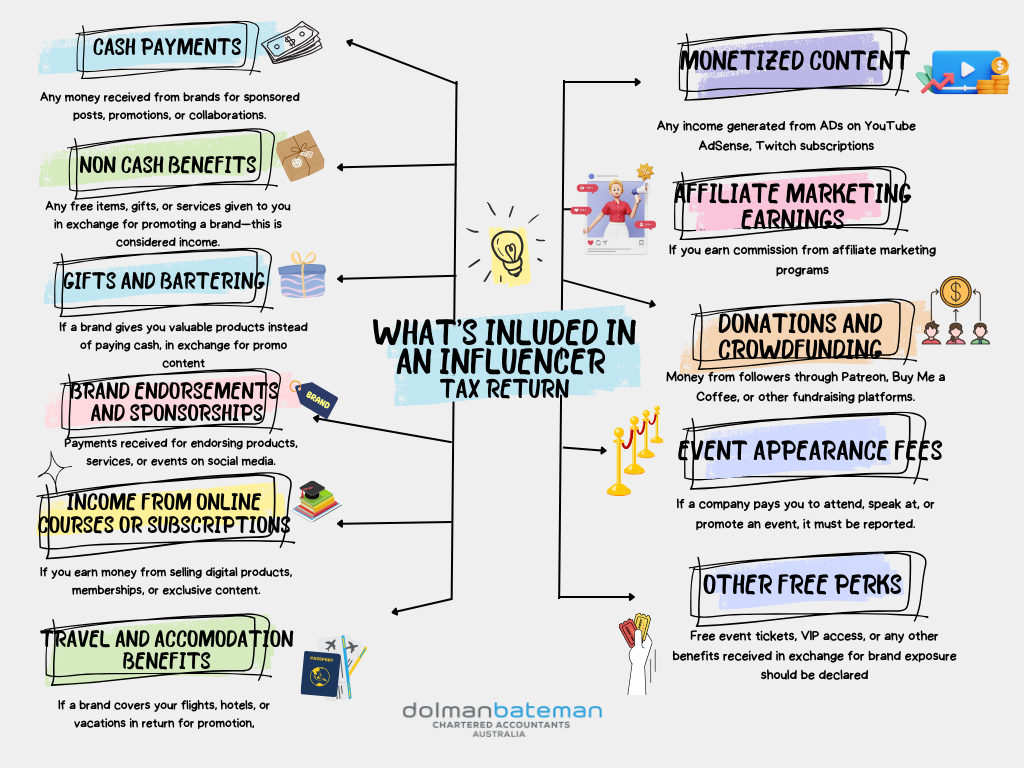

What Counts as Income for Influencers?

Income isn’t limited to money transferred to your bank account. The ATO considers all of the following taxable:

Cash payments from sponsorships and affiliate programs

PR gifts and freebies given in exchange for promotion

Brand collaborations, ad revenue, and content licensing

Overseas payments from global platforms

Appearance fees and paid event invites

Example: A brand sends you a $5,000 designer handbag in exchange for a shoutout. That counts as $5,000 of income—even if you didn’t see any cash.

What If You Don’t Report It?

If you fail to declare this income:

You risk being audited

You could owe back taxes, interest, and penalties

The ATO may already have a record, especially if the brand is claiming the gift as a business deduction

How to Declare Your Influencer Income

If you’re a sole trader, you report income in your individual tax return under your ABN.

If you’ve set up a company, different rules apply—but you still need to report all income.

If you’re earning over $75,000, you must register for GST and charge it on services like sponsored posts.

Tip: Set up PAYG instalments if your income is regular. It’ll make tax time a lot less painful.

Let Dolman Bateman Handle It for You

We understand influencers—because we work with them every day.

At Dolman Bateman, we:

✔ Guide you on registering an ABN or company

✔ Help set up tax-effective structures

✔ Ensure you claim every eligible deduction

✔ Lodge your BAS and tax returns accurately

✔ Help you avoid fines, audits, and tax traps

Book a consultation today!

Let’s get your influencer tax sorted before the ATO comes knocking.

Disclaimer:

The information provided in this article is general in nature and does not constitute personal financial, legal or tax advice. While every effort has been made to ensure the accuracy of this content at the time of publication, tax laws and regulations may change, and individual circumstances vary. Dolman Bateman accepts no responsibility or liability for any loss or damage incurred as a result of acting on or relying upon any of the information contained herein. You should seek professional advice tailored to your specific situation before making any financial or tax decision.