How To: EIN Number

- Arnold Shields

- May 5, 2018

- 2 min read

Updated: May 21, 2025

EIN - Employer Identification Number

A Federal Number issued by IRS for identifying businesses in USA.

Application Form - SS-4 (Download here)

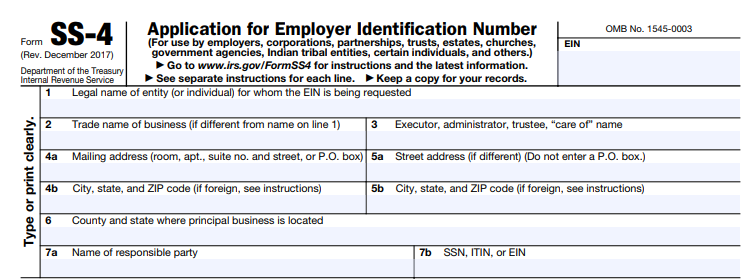

How to fill in the SS-4.

Name of your company - ie Company Name Pty Ltd

Leave blank

Leave blank

Mailing Address - Include "Australia" in 4b

Street Address - your Home address - include "Australia" in 5b

State in Full - "New South Wales, Australia"

a. - Name of Director b. - Leave Blank

8.a - N0 b. Leave Blank c. Leave Blank

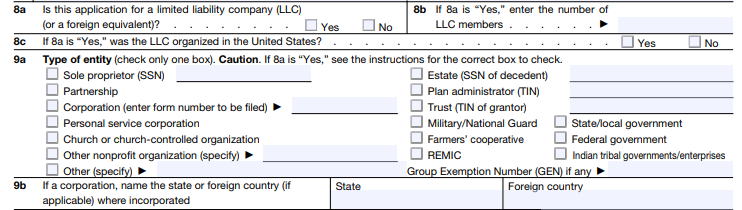

9. a) Corporation -> Form: 1120F b) Australia

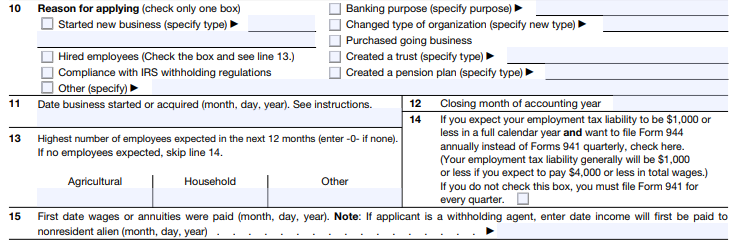

10. Started New Business - eCommerce.

11. Date business started in USA

12. June

13. 0 (Zero) to all.

14. Leave Blank

15. "N/A"

16. Retail

17. Description of Product

18. "No"

Apply by Telephone – International Applicants International applicants may call 0011-1-267-941-1099 (not a toll-free number) 6:00 a.m. to 11:00 p.m. (Eastern Time) Monday through Friday to obtain their EIN. The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 (PDF), Application for Employer Identification Number. Complete the Third Party Designee section only if you want to authorize the named individual to receive the entity’s EIN and answer questions about the completion of Form SS-4. The designee’s authority terminates at the time the EIN is assigned and released to the designee. You must complete the signature area for the authorization to be valid.

Disclaimer:

The information provided in this article is general in nature and does not constitute personal financial, legal or tax advice. While every effort has been made to ensure the accuracy of this content at the time of publication, tax laws and regulations may change, and individual circumstances vary. Dolman Bateman accepts no responsibility or liability for any loss or damage incurred as a result of acting on or relying upon any of the information contained herein. You should seek professional advice tailored to your specific situation before making any financial or tax decision.