PAYG Tax Scam Thwarted by Changes to Australian Tax Laws

- Arnold Shields

- Aug 15, 2012

- 1 min read

Updated: Jun 3, 2025

At the end of June this year, changes in legislation on Tax were made in attempt to close off tax scams involved in phoenixing activity.

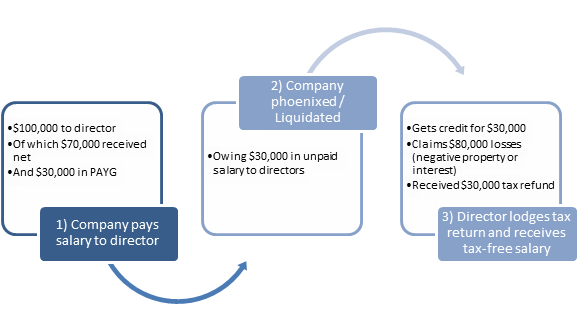

Previously directors were able to pass on the PAYG withholding liabilities to the company entity. This allowed for the situation where companies could file for bankruptcy, whilst the entity was still owing PAYG tax collected. See below for an example, of how the tax scam worked before the changes were made.

The tax changes were made through implementing a new PAYG withholding non-compliance tax which was equal to the amount of unpaid PAYG witholding amounts by the company. Therefore more accountability is placed on directors deterring upper management from exploiting such tax loopholes.

In fact, a report by the Fair Work Ombudman phoenix activity costs Australia between $1.78 and $3.19 billion a year and between $601 and $610 million worth of revenue a year as a result of unpaid tax.

Disclaimer:

The information provided in this article is general in nature and does not constitute personal financial, legal or tax advice. While every effort has been made to ensure the accuracy of this content at the time of publication, tax laws and regulations may change, and individual circumstances vary. Dolman Bateman accepts no responsibility or liability for any loss or damage incurred as a result of acting on or relying upon any of the information contained herein. You should seek professional advice tailored to your specific situation before making any financial or tax decision.