How to amend PAYG Payment Summary Statement

- Aug 13, 2010

- 2 min read

Updated: Jun 18, 2025

It’s come to our attention that many employers are making a critical reporting error on their PAYG Payment Summary, Individual Non Business forms.

The mistake? Incorrectly including the 9% Superannuation Guarantee (SG) contributions under the Reportable Employer Superannuation Contributions (RESC) label.

This is not just a clerical error, it can lead to misinformation being lodged with the ATO and misleading income details for your employees.

What Should Be Reported?

To clarify:

The 9% Superannuation Guarantee is not reportable at the RESC label.

Only additional superannuation contributions made at the direction of the employee (such as salary sacrifice or extra voluntary employer contributions) are reportable under this label.

What To Do If You’ve Made This Mistake

If you’ve already issued PAYG Payment Summaries and realise that you’ve reported the SG amount incorrectly, you must lodge an amended PAYG Payment Summary Statement.

According to the ATO, you’ll need to:

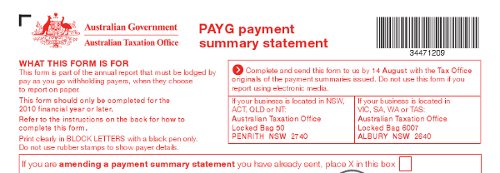

Complete a new PAYG Payment Summary Statement.

Mark the ‘amending a payment summary statement’ box with an “X”.

Include:

All the corrected payment summaries that have changed

Any payment summaries you didn’t previously send

List all payment summaries issued by you for the financial year – not just the amended ones.

Important: You only need to lodge copies of the amended payment summaries and any previously unsubmitted summaries, not all original summaries.

Lodging Your Amendment

You can submit amended forms in two ways:

1. Electronically

Via ECI (Electronic Commerce Interface) or

An electronic file through your accounting/payroll software(If only the dollar amounts changed, simply lodge the updated file. If your software can’t produce amended files, use printed forms instead.)

2. Paper Lodgement

Order hard copy forms using the ATO’s online ordering service:www.ato.gov.au/onlineordering

Need Help Correcting Your PAYG Summaries?

If you’ve found errors in your payment summaries or aren’t sure how to correctly classify superannuation contributions, get in touch with the team at Dolman Bateman. We’ll help you correct your PAYG reports and make sure your superannuation reporting is compliant.

Disclaimer:

The information provided in this article is general in nature and does not constitute personal financial, legal or tax advice. While every effort has been made to ensure the accuracy of this content at the time of publication, tax laws and regulations may change, and individual circumstances vary. Dolman Bateman accepts no responsibility or liability for any loss or damage incurred as a result of acting on or relying upon any of the information contained herein. You should seek professional advice tailored to your specific situation before making any financial or tax decision.